Photo by Chip Somodevilla/Getty Images

Major tax reform only comes about once every thirty years. The GOP tax bill that passed through Congress Tuesday night is on its way to Donald Trump’s desk where he is expected to sign it into law.

Here are the top 5 things you need to know:

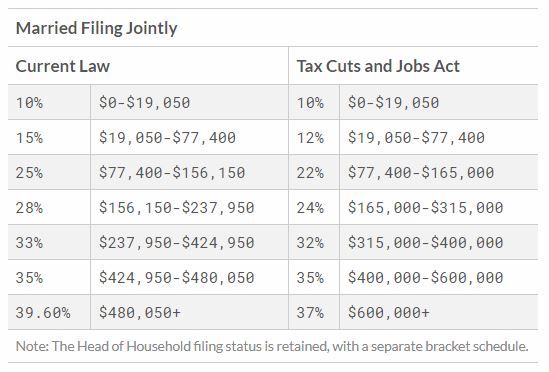

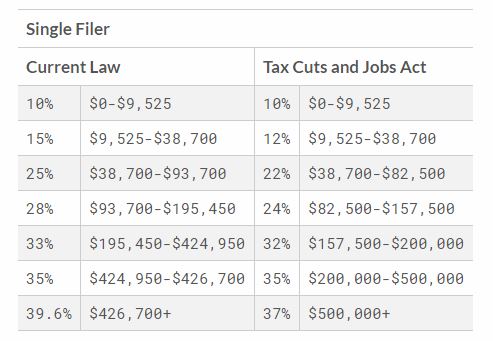

- Tax brackets change on January 1

- Expands the child tax credit

- If you have kids, or plan to soon, you’ll be eligible for the expanded child tax credits aimed at families which includes as much as $2,000 per kid. Although you may not be eligible for the entire benefit, even without a tax liability, you’ll still get $1,400 per child back.

- Raises the exemption on the alternative minimum tax

- from $86,200 to $109,400 for married filers, and increases the phaseout threshold to $1 million.

- Repeals the Health Care Mandate

- The upside is that if you don’t want to buy health care, you won’t be penalized for skipping it. On the other hand, everyone who chooses to buy healthcare can expect premiums to rise by about 10% in the following decade.

- You won’t see most of the effects of these changes until 2019

- For the 2017 tax year, the standard deduction for single taxpayers is $6,350. In other words, you won’t get to use the newly passed $12,000 standard deduction when you file your 2017 taxes in April 2018. Likewise, married couples filing jointly will see a bump from $12,700 to $24,000, but that won’t impact their household finances until they file in April 2019. So, don’t start budgeting around that big tax return, yet.

TELL US: What do you think of the new tax reform laws?

Like TV One on Facebook and be sure to follow us on Instagram and Twitter.