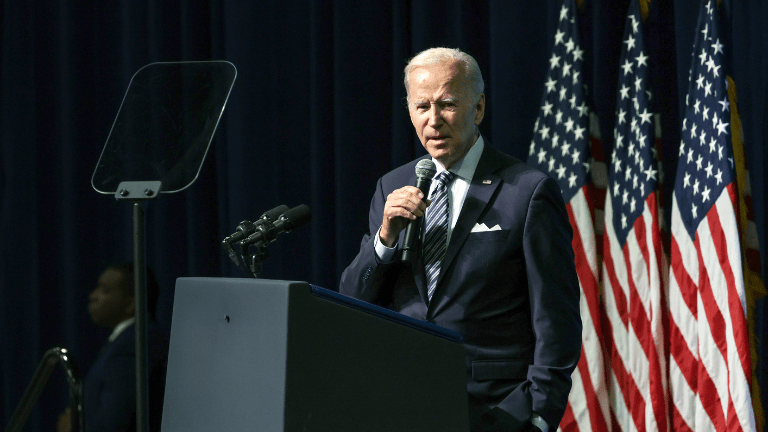

Photo by: Alex Wong/Getty Images

President Joe Biden’s recent announcement, on Wednesday, August 24th regarding one huge promise he made while running for president has folks talking.

In an effort to address student loan debt, Biden announced loan forgiveness of up to $20,000 for those eligible and an extension to the payment freeze one last time through the end of the year.

The move comes as part of the Biden administration’s plan to “give working- and middle-class families breathing room as they prepare to resume federal student loan payments in January 2023,” he tweeted, as he announced his plan.

Borrowers were initially scheduled to restart payments at the end of this month.

Under the new plan, those earning less than $125,000 per year, or couples earning less than $250,000 per year, will be eligible for up to $10,000 in loan forgiveness.

Another $10,000 of loan forgiveness is available to students who are Pell Grant recipients, which means they have the greatest financial need.

Additionally, some loan payments will have a 5% cap on monthly income.

“An entire generation is now saddled with unsustainable debt in exchange for an attempt at least at a college degree,” President Biden explained.

He continued.

Photo by: Kevin Dietsch/Getty Images

“The burden is so heavy that even if you graduate, you may not have access to the middle-class life that the college degree once provided.”

Senior administration officials who described the terms of the plan on a call with reporters said that future students will not be eligible for debt relief, but current students will.

According to a Times Magazine contributor, and Executive Director of the Center for Social Justice at UC Berkeley School of Law, Savala Nolan expressed how President Joe Biden’s student loan forgiveness plan doesn’t benefit or forgive those who are African Americans and have student loans debts.

“There’s some theoretical truth to this, but ultimately this “solution” is doubly disappointing: it’s not a big or bold enough reimagining of how we treat education in general, and it completely misses the mark for Black Americans in search of a country that wants racial justice,” Nolan expressed.

According to the Postsecondary National Policy Institute, in 2019, 29% of the Black population aged 25 to 29 held a bachelor’s degree or higher, compared to 45% of the white population in the same age range.

According to Brookings Institution, Black Americans make disproportionately less money than their fellow white counterparts, in addition, Black Americans have one-sixth the wealth of White Americans on an average, per capita basis.

Photo by: Andy Sacks/ Getty Images

According to the Brookings Institute, the average Black borrower has a debt of approximately $53,000 whereas the average white borrower has a debt of approximately $28,000 four years after graduation.

According to the Education Data Initiative, after the same four years, 48% of Black students owe, on average, 12.5% more than they borrowed, whereas 83% of White students owe, on average, 12% less.

Two-thirds of those who have student loan debt are women. The White House also reports that 60% of the “borrower population” are Pell Grant recipients (those with extraordinary financial needs).

The average borrower owes more than $30,000 in student loans, but the amount is significantly greater for women of color.

According to the American Association of University Women’s recent research, Black women owe an average of $41,466.

Photo by: Peter Cade/Getty Images

According to the United Negro College Fund, Pell Grants are available to more than 70% of students at historically Black schools and universities. However, compared to white borrowers, Black borrowers owe twice as much in debt.

The long-awaited announcement quickly caused a field day on social media.

“President Biden’s student debt plan will forgive the remainder of my undergraduate loans. I’m a first-generation college graduate, a Pell grant recipient, and as of today a Master’s student at Georgetown. This is what economic mobility looks like. Thanks Joe! 🙌🏾,” one person tweeted.

Another person stated, “I was a working student and after graduation, I always paid a little extra to knock down my principal balance… this morning my student loan balance was 7k. Thanks to President Biden, I’m debt free. #studentloanforgiveness.”

However, this plan of putting a student loan forgiveness course in action has received backlash.

“We can fund Ukraine but not eliminate student loan debt the basis of the 2020 campaign….. Other countries keep getting money from us and we can’t eliminate #studentloans! The math ain’t MATHING @POTUS! #education #college #studentloanforgiveness,”

Some users also pushed back on the need to use their own money to wipe out student loan debt.

“Remind me again why myself along with millions of others that are in debt trying to keep our family going, is going into more debt by paying others student loans?,” one person tweeted in response to the news.

Another person exclaimed: “Just listen to President Biden give money to college students who had loans. How dare you give my money away. As a college graduate who paid for schooling with GI Bill and loans. Paid it all back.”

According to the president and the Education Department, this pause on student loan payments is the final extension of the pandemic-era hiatus.

Nearly 8 million debtors may be eligible to have their debt immediately forgiven; others will need to seek relief, officials said.

Borrowers can click here to sign up for notifications and stay up to date when the application is available.

The suspension of student loan repayments started under the Trump administration at the start of the pandemic, and since President Biden took office, it has been suspended a total of four times.

According to a Financial Health Network analysis from April, the zero percent interest rate delay has helped borrowers of federal student loans avoid paying more than $1.5 billion in interest each month.

Thoughts?

Like TV One on Facebook and be sure to follow us on Instagram and Twitter.